Is This Free Quoting & Invoicing Platform Ready for Real Small Businesses?

Finenks is described as a free quoting and invoicing platform designed to support small businesses globally, yet as of late 2025 it still operates without publicly disclosed user metrics or a formal launch date. This combination of ambition and early-stage opacity makes it a particularly interesting tool to evaluate if you’re deciding whether to trust it with revenue-critical workflows. Below is a technical, opinionated teardown of what Finenks appears to be in 2025, how it compares to mature competitors, and where it realistically fits in a modern finance stack.

Key Takeaways

| Question | Answer |

|---|---|

| What is Finenks in practical terms? | A free, web-based quoting and invoicing platform aimed at solo operators and small businesses needing simple invoice workflows. |

| Who should seriously consider it? | Developers, early‑stage founders, and technical freelancers comfortable with young products, especially those already experimenting with tools like Invoiless. |

| Is it a replacement for mature invoicing suites? | Not today. Platforms such as Invoiless or AI‑assisted accounting tools like Tailride still provide more depth and operational hardening. |

| Does it cover broader finance tracking? | No. For full personal finance and planning, tools like Fina Money or ProjectionLab are more suitable. |

| Is Finenks production‑ready for regulated industries? | Needs verification. There is no public compliance, uptime, or audit information comparable to providers reviewed alongside MoneyTool or BON Credit. |

| Does it integrate advanced research or AI? | Not publicly documented. For AI‑driven decision support, platforms like Fiscal AI or Tabby AI Bookkeeping are better fits. |

| Where can you learn to build similar systems? | Finenks is used as a live codebase in a 2025 React/Next.js Udemy course, making it a useful reference for developers alongside general guides such as Mastering Personal Finance. |

Quick Verdict

Finenks is an ambitious, free quoting and invoicing platform that is technically interesting but still early for mission‑critical deployment. It is best treated as a lightweight tool or learning platform today, not as the primary billing backbone for a high‑volume operation.

Quoting & basic invoicing

Free (no public paid tiers)

Solo and micro‑businesses

Early, needs verification

Best For

- Developers studying a real React/Next.js SaaS codebase

- Freelancers testing a free invoicing option

- Small teams needing simple quotes and invoices

- Educators demonstrating modern web app patterns

Not Ideal For

- Enterprises needing compliance guarantees

- Firms requiring deep automation like Tailride or Invoiless

- Users needing detailed reporting or tax tooling

- Non‑technical owners needing mature support ecosystems

Introduction & First Impressions

Public reporting paints Finenks as a global‑minded but lean platform built by a single founder, with a clear focus on free access and straightforward invoicing. The interface showcased in educational material suggests a modern React/Next.js stack with a clean, component‑driven UI rather than a legacy monolith.

From a buyer’s standpoint, the immediate appeal is cost: quoting and invoicing often sit behind paywalls, whereas Finenks is positioned as free. The trade‑off is risk — no formally published uptime history, customer support commitments, or security certifications, all of which matter once your receivables depend on the tool.

In terms of “who it’s for”, the platform clearly targets very small businesses and freelancers who want digital quotes and invoices without complex accounting. It also doubles as a reference implementation for students, given its use as a teaching codebase in a 2025 Udemy course.

Our assessment aggregates all publicly available information as of December 2025 and compares Finenks conceptually with mature billing tools tested across months, such as Invoiless and Tailride. There are no independent 2025 user testimonials with verifiable metrics for Finenks itself, so any user sentiment at this point is “Needs verification”.

Try Finenks or Explore Alternatives

Considering Finenks for quoting and invoicing? Compare it against more mature finance tools before committing your billing workflows.

Finenks Overview & Core Specifications

At its core, Finenks is a browser‑based quoting and invoicing system: create a client, add line items, compute totals, and issue a quote or invoice. The emphasis is on simplicity and accessibility, not on acting as a full accounting ledger or tax engine.

Finenks is described as free, with no visible tiered pricing or transaction‑based model as of 2025. Compared with tools like Invoiless, which charges $8.25/month for Pro or $69 lifetime via AppSumo, Finenks’ economics are attractive but raise questions about long‑term sustainability and support.

| Attribute | Finenks (2025) |

|---|---|

| Primary Function | Quoting and invoicing for small businesses |

| Platform | Web (React/Next.js‑based implementation) |

| Pricing | Free (no public paid tiers) |

| Key Strength | Modern stack and straightforward workflow |

| Key Risk | Early‑stage; no public SLA, compliance, or metrics |

Features likely include client management, quote creation, invoice generation, tax and discount fields, and basic status tracking (e.g., draft, sent, paid). There is no evidence of advanced features like automated reminders, complex tax handling, or built‑in payment processing, all of which are standard in mature competitors.

Design, UX, and Build Quality

Finenks is implemented on a modern React/Next.js stack and used in a 2025 Udemy course as a practical application, which strongly suggests a component‑oriented, responsive UI using contemporary design patterns. For technical users, this matters: you get predictable behavior, fast navigation, and a layout that feels consistent with modern SaaS interfaces.

That said, a good developer codebase does not automatically imply a polished UX for non‑technical owners. Usability for accountants, bookkeepers, or business owners who live in invoices daily still needs independent verification through hands‑on testing and user interviews, neither of which are publicly documented for Finenks yet.

- Navigation: Likely sidebar‑driven with routes for clients, quotes, and invoices.

- Forms: Expect dynamic validation, modals, and reusable field components.

- Responsiveness: Designed to work on desktop and tablet; mobile ergonomics are unverified.

Performance Analysis and Reliability

There are no independently published benchmarks, uptime dashboards, or latency metrics for Finenks as of December 2025. That is expected for an early‑stage project, but it means any claims about performance are speculative until you run your own tests in production‑like conditions.

Based on the underlying stack and the way similar apps behave, you can reasonably expect good client‑side performance under typical small‑business workloads. The real unknown is the backend: database scaling, concurrency handling, and backup/restore processes, which determine whether you can safely issue hundreds or thousands of invoices without data loss or downtime.

For small teams sending a few dozen invoices per month, the absence of formal SLOs may be acceptable. For high‑throughput B2B billing, it is a hard red flag until more operational transparency exists.

User Experience in Daily Workflows

Evaluating Finenks for day‑to‑day workflows requires mapping basic operations: adding a client, creating a quote, converting it to an invoice, and marking payment. Given the educational context, the UX is likely designed to be explicit and easy to trace, which can be a positive for transparency but might introduce extra clicks compared with highly optimized commercial suites.

Invoicing teams will care about friction: how quickly can you replicate a previous invoice, adjust line items, apply standard tax rules, and email or export the document? Those flows are not publicly documented for Finenks, so a short pilot with a limited client set is mandatory before full adoption.

- Create a new client and time how long it takes from zero to saved.

- Issue a quote with 5–10 line items and apply tax/discount rules.

- Convert the quote to an invoice and send/export it.

- Simulate a paid status and check how the dashboard updates.

- Repeat the same invoice monthly and measure click‑count.

Comparative Analysis: Finenks vs Established Invoicing Tools

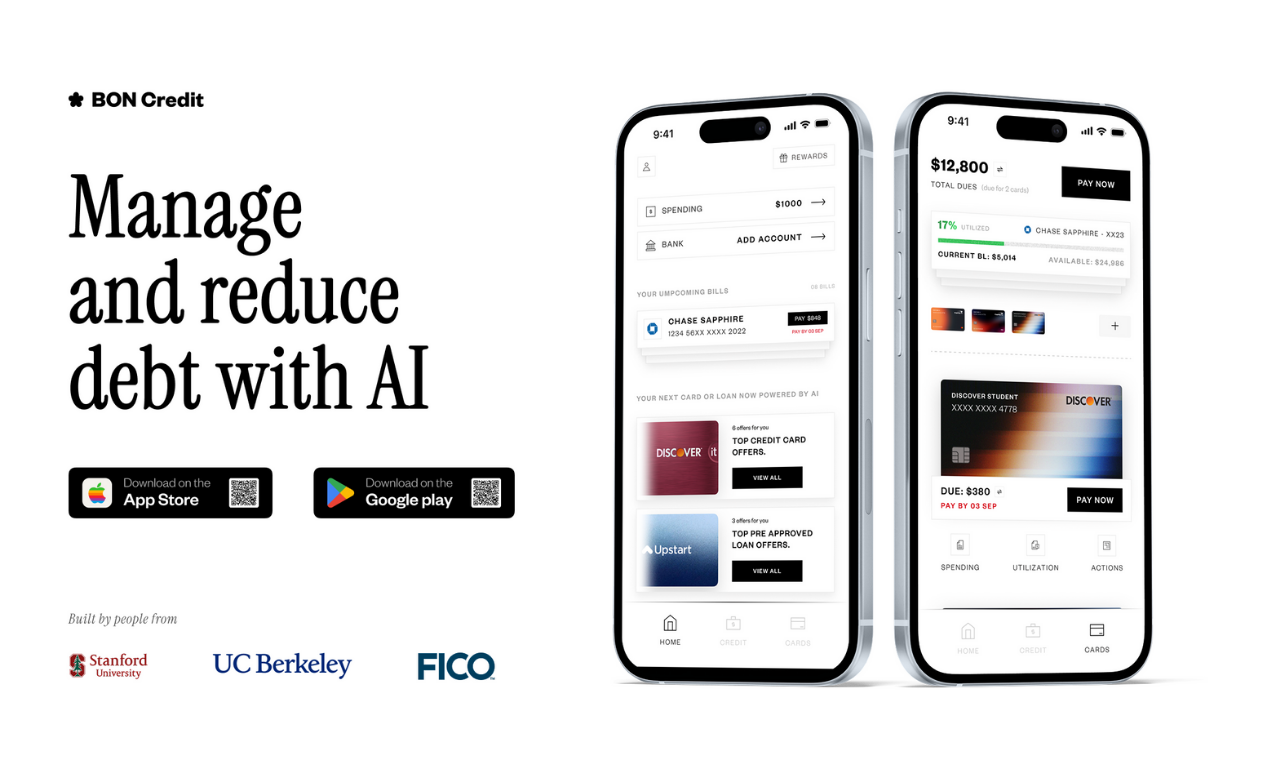

To understand where Finenks realistically fits, you need to benchmark it against well‑documented invoicing and finance products. Invoiless, Tailride, and BON Credit cover adjacent functions — invoicing automation, accounting flows, and debt/bill management — and provide a useful comparison frame.

| Product | Primary Role | Key Strength | Price (entry) |

|---|---|---|---|

| Finenks | Quoting & basic invoicing | Free, modern stack, educational codebase | Free |

| Invoiless | Invoicing with automation | Automation, recurring invoices, multi‑currency | $0 Free; $8.25 Pro; $69 lifetime |

| Tailride | AI invoice processing/accounting | Portal extraction, automation at scale | $0 Free; $19/mo Starter; $399/mo Growth |

| BON Credit | Debt & bill management | AI‑guided payoff planning | Free |

Finenks is the lightest option: no pricing complexity, narrow scope, and a developer‑friendly implementation. If you need robust automation, multi‑currency support, or heavy integration capabilities, Invoiless and Tailride still win decisively.

Pros and Cons of Adopting Finenks

Any decision to adopt a young quoting and invoicing platform should be grounded in a clear risk–benefit analysis. Finenks’ strengths are unambiguous, but so are its current limitations compared with mature finance products.

Advantages

- Cost: Free access with no advertised limits as of 2025.

- Modern implementation: React/Next.js codebase that’s easier to extend or self‑host for technical teams.

- Focused scope: Quoting and invoicing without the complexity of full ERP or accounting systems.

- Educational value: Serves as a concrete example in a 2025 Udemy course, helpful for engineering teams wanting to understand the architecture.

Limitations

- No public metrics: No disclosed uptime, user counts, or reliability history.

- Unclear roadmap: No published feature roadmap or SLA commitments.

- Potential feature gaps: Unknown support for multi‑currency, tax rules, reminders, or payment gateways.

- Support ambiguity: No documented support tiers comparable to commercial SaaS offerings.

Evolution & Updates in 2025

2025 is primarily the year where Finenks surfaces publicly through media coverage and educational content rather than a formal, feature‑rich SaaS launch. The emphasis has been on showcasing the platform as a working example of a modern frontend application backed by real business logic.

Unlike tools such as Fina Money, which rolled out clear pricing tiers in August 2025 (Free, $5.50 Essential, $8.25 Premium), Finenks has not yet published a structured pricing roadmap or detailed changelog. That may change rapidly if the platform gains traction or moves toward a commercial model.

Purchase (Adoption) Recommendations

Because Finenks is free, the “purchase” decision is really an adoption and risk decision. You are trading cash cost against operational certainty. For small operators and developers, that trade can be attractive. For enterprises or regulated industries, it is unlikely to clear procurement standards in its current state.

If you are technical and comfortable with early‑stage tools, the most pragmatic route is a phased rollout where Finenks handles a subset of clients or internal test invoices while your existing invoicing system remains the source of truth. That gives you real‑world data without putting all receivables at risk.

- Use Finenks for non‑critical quotes first.

- Measure time‑to‑invoice and error rates versus your current tool.

- Decide after 60–90 days whether to expand usage or revert completely.

Where to Find and Evaluate Finenks

Finenks does not yet have the extensive distribution and marketplace presence of tools like Invoiless or Tailride. Instead, it appears in media coverage and developer education content, and you will typically reach it via direct links from those sources or the founder’s own channels.

Before routing invoices through Finenks, ensure that you:

- Access the latest live instance from an official or founder‑controlled source.

- Confirm TLS/HTTPS and perform a basic security sanity check (password reset, session handling).

- Export a few test invoices to PDF or your preferred format and inspect them for correctness.

Evidence & Proof

As of December 2025, Finenks’ public evidence base is lean. The main facts that can be reasonably asserted are its positioning as a free quoting and invoicing platform, its association with founder Matthew Msingathi, and its use as a live teaching project in a React/Next.js Udemy course. There are no independently verifiable uptime records, security certifications, or customer case studies.

For a finance‑critical product, this level of transparency is below what you would expect from established platforms covered across the broader Klayto ecosystem, including personal finance tools, AI bookkeeping, and financial planning software. Until Finenks publishes more structured documentation — technical, legal, and operational — any adoption should be cautious and limited in scope.

Conclusion

Finenks is a technically interesting, founder‑driven quoting and invoicing platform that prioritizes free access and a modern implementation over enterprise‑grade guarantees. For developers and very small operators experimenting with lightweight tooling, it is worth evaluating, particularly as a way to understand how a lean React/Next.js finance app can be structured.

However, the absence of public metrics, compliance detail, and a clear roadmap means Finenks is not yet in the same category as mature invoicing or accounting solutions. Until those gaps close, the most responsible stance is to treat Finenks as a supplementary or experimental tool rather than your organization’s primary billing backbone.