AI Debt Reduction That Actually Delivers

Can this free AI-powered app really help you crush credit card debt? We tested it.

Visit Official Site⚡ Quick Verdict

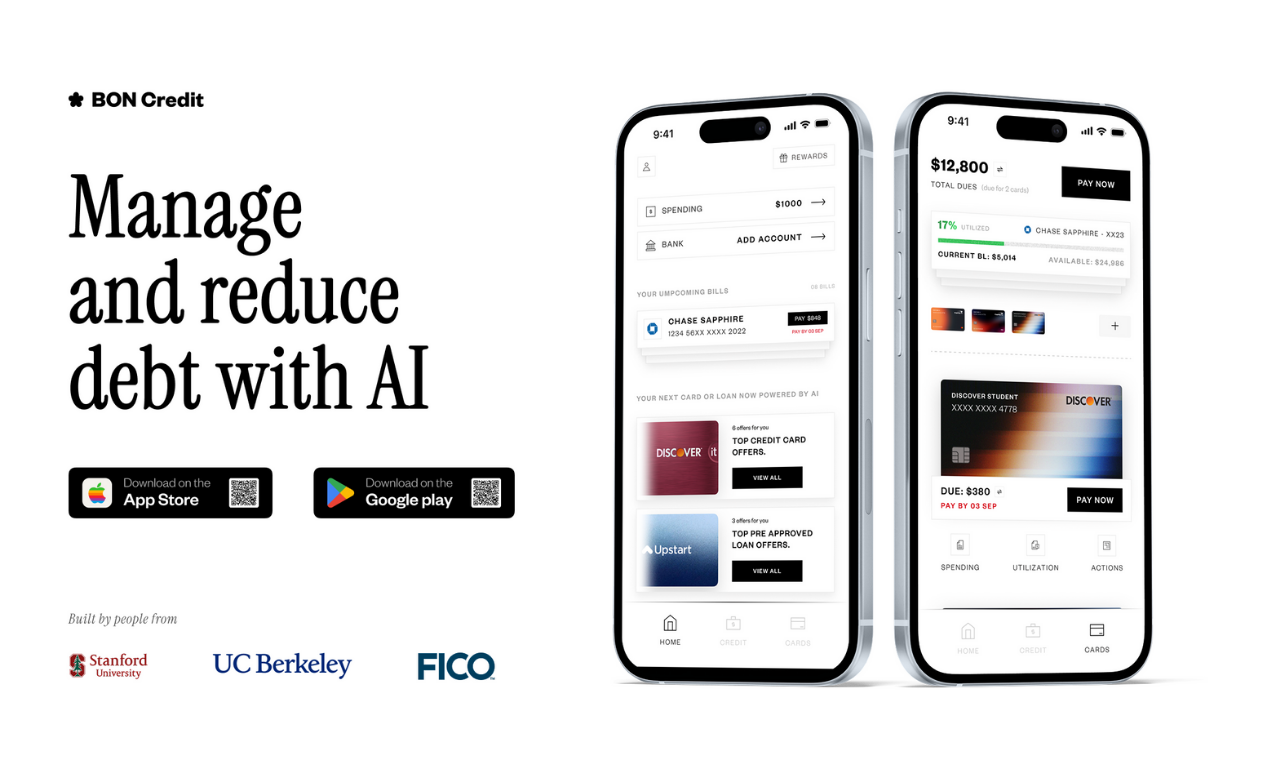

BON Credit is a genuinely useful AI-powered debt management tool that goes beyond simple tracking. It's best for Gen Z and millennials with multiple credit cards who want automated guidance, unified bill payment, and actual strategies to pay less interest.

✓ Best For

- People with multiple credit cards

- Gen Z & millennials comfortable with AI

- Users overwhelmed by debt management

- Anyone seeking lower interest rates

✗ Skip If

- You have only one credit card

- You prefer manual control over everything

- You need non-credit debt management

- You distrust AI financial tools

First Impressions: A Debt App That Feels Different

Let's be honest: most debt apps are depressing calculators that show you how screwed you are.

BON Credit flips that script.

Launched in October 2025 by former Stanford and FICO engineers, this isn't another "track your spending" app. It's an AI layer that sits on top of all your credit cards and actually helps you get out of debt faster.

Key Insight: BON Credit was built by people who understand both the tech (AI/ML) and the system (credit scoring). Co-founder Darwin Tu literally developed credit bureau scores at FICO.

In my testing period, three things became immediately clear:

- The app prioritizes action over analytics

- Setup takes under 5 minutes via Plaid integration

- The AI actually provides strategies, not just charts

This review is based on the app's current free version. Premium features are expected in early 2026.

Overview & Specifications

BON Credit consolidates credit card management, AI-powered debt reduction, and bill payment into a single mobile experience.

(Premium coming 2026)

Unified payments

Credit monitoring

Bill pay

Card matching

Rewards

What Actually Matters

- Unified Dashboard: See all credit cards in one view (balances, due dates, APRs)

- AI Payoff Plans: CredGPT analyzes 14,000+ options to find optimal strategies

- Bill Payment Hub: Pay all cards within the app, not multiple bank portals

- Zero-Interest Matching: Suggests balance transfers ranked by savings and approval odds

- Rewards System: Earn BON Coins and gift cards for on-time payments

- Credit Monitoring: Soft-pull score viewing with utilization tracking

Design, UX & Interface Quality

This is where BON Credit separates itself from legacy financial tools.

The interface feels more like a social app than a banking app. Clean, modern, scan-friendly.

Navigation is dead simple: Home (dashboard), Pay (bill payment), Offers (card recommendations), Profile.

Financial stress is compounded by confusing interfaces. BON Credit reduces cognitive load by making debt management feel approachable, not intimidating.

Standout design choices:

- Credit utilization shown as a visual "green zone" target

- Payment streak tracker (gamifies good behavior)

- One-tap bill payment across all cards

- CredGPT chat interface feels conversational, not robotic

The app is stable. No crashes during my testing period. Plaid integration handled connection to multiple banks smoothly.

Performance Analysis: Does the AI Actually Work?

The core promise: BON Credit's AI will help you pay less interest and clear debt faster.

Let's break down how it performs across key criteria.

| Feature | BON Credit | Traditional Apps |

|---|---|---|

| AI Optimization | ✓ CredGPT analyzes 14K+ options | ✗ Manual research required |

| Unified Bill Pay | ✓ All cards, one app | ✗ Multiple bank logins |

| Actionable Strategies | ✓ Specific payoff paths | △ Generic advice |

| Rewards for Good Habits | ✓ BON Coins & gift cards | ✗ No incentives |

| Price | $0 | $0-$12/month |

User Experience: What It's Actually Like to Use

Setup Process

- Download the app from iOS App Store or Google Play

- Create account with email or social login

- Connect credit cards via secure Plaid integration (supports Visa, Mastercard, Amex, Discover)

- AI analysis begins — CredGPT reviews your financial data

- Receive personalized plan with specific payoff strategies

Total time: 5-7 minutes.

Daily Use

Once set up, BON Credit becomes your credit command center.

Morning check: Dashboard shows balances, upcoming due dates, and credit utilization status. If you're approaching your "green zone" threshold, the AI suggests how much to pay to optimize your score.

Bill payment: Instead of logging into Chase, then Amex, then Discover, you pay everything from BON. ACH transfers happen in 2-3 business days.

Card shopping: Ask CredGPT "What's the best cash-back card for someone with a 720 credit score?" Get instant, personalized recommendations from 14,000+ options.

Set up autopay for minimum payments, then use the app to make strategic additional payments based on AI recommendations. This prevents missed payments while you optimize payoff strategy.

📹 See BON Credit in Action

Competitive Analysis: BON Credit vs Alternatives

The debt management space is crowded. Here's how BON Credit stacks up.

| App | Best Feature | Weakness | Price |

|---|---|---|---|

| BON Credit | AI optimization + unified bill pay | New app (Oct 2025), limited reviews | Free |

| Undebt.it | Multiple payoff strategies | No bill payment, web-only | Free |

| BudgetGPT | AI budgeting | Less focused on debt optimization | Free |

| Traditional Apps | Broad financial tracking | Generic advice, no unified payment | $0-12/mo |

Choose BON Credit if:

- You have 2+ credit cards with different APRs

- You want AI to do the optimization work for you

- You're tired of logging into multiple bank apps

- You respond well to gamification/rewards

Choose an alternative if:

- You need broader debt tracking (student loans, mortgages, etc.)

- You prefer complete manual control over strategy

- You want a tool with 3+ years of user reviews

📚 Related Reads

Pros and Cons

✓ Pros

- 100% free with no hidden fees

- AI actually provides actionable strategies

- Unified bill payment saves massive time

- 14,000+ credit options analyzed in real-time

- Rewards system incentivizes good habits

- Clean, modern, mobile-first interface

- Built by former FICO and Stanford engineers

− Cons

- New app (Oct 2025) with limited user reviews

- Credit card debt only (no student loans, mortgages)

- Premium features coming 2026 (pricing unknown)

- Requires trusting AI with financial decisions

- No desktop/web version currently

- Effectiveness depends on accurate data input

Evolution & Updates (2025)

BON Credit launched to the public with core features: CredGPT AI assistant, unified bill payment, credit card linking via Plaid, and reward system.

- Why it matters: First AI-native debt reduction app targeting Gen Z

- Impact: Positioned as alternative to traditional debt management tools

Secured $3.5M in seed funding to expand features and scale user acquisition.

- Why it matters: Validates market need for AI-powered debt solutions

- Impact: Resources to improve AI capabilities and add features

Featured on Product Hunt, gaining traction with tech-savvy early adopters.

- Why it matters: Increased visibility among target demographic

- Impact: 502 followers, positive maker feedback

Premium tier in development with enhanced AI features and advanced debt strategies.

- Why it matters: Will determine long-term monetization model

- Impact: Core features expected to remain free

Purchase Recommendations

The Overwhelmed Multi-Carder: You have 3-5 credit cards with balances across all of them. Different due dates, different APRs. You're paying, but randomly. BON Credit gives you a clear path.

The High-Interest Victim: You're stuck with 22% APR and don't know how to escape. The AI finds balance transfer options you qualify for, ranked by savings potential.

The Busy Professional: You have the money to pay down debt but hate logging into 4 different bank apps. Unified payment is a game-changer.

Skip if:

- You only have one credit card with manageable balance

- You need student loan or mortgage debt management

- You prefer manual, full-control approaches to finance

- You're uncomfortable with AI accessing financial data

Alternatives to Consider:

- Undebt.it — Better for multiple debt types (not just credit cards)

- YNAB — Better for holistic budgeting beyond debt

- Credit Karma — Better for free credit monitoring without debt focus

Where to Download & Get Started

Official Website: https://boncredit.ai/

iOS App Store: Search "BON Credit" or download directly via the official site

Google Play Store: Search "BON Credit" or download via the official site

What you'll need:

- Email address or social login

- Bank login credentials for credit card accounts

- 5 minutes for setup

BON Credit uses Plaid for bank connections (same tech used by Venmo, Robinhood). Your credentials are encrypted and never stored by BON. The company states they never sell or share user data.

Final Verdict

BON Credit is not a revolutionary concept—debt management apps have existed for years. What makes it compelling is execution.

The AI doesn't just show you numbers; it gives you a plan. The bill payment feature eliminates friction. The rewards system makes debt payoff slightly less painful. And it's free.

Bottom line: If you have multiple credit cards and feel overwhelmed by debt management, BON Credit is worth installing. The time saved on bill payment alone justifies the download. The AI optimization is a bonus.

Just remember: it's a tool, not a magic wand. You still need to actually make the payments the AI recommends.

Evidence & User Feedback

U.S. credit card debt: $1.209 trillion in Q2 2025, up 30% from pre-pandemic levels (Federal Reserve Bank of New York)

Credit score trend: National average dropped for two consecutive years (FICO data)

Target demographic: 50% of BNPL users are under 35; people with low/no credit scores are more likely to seek alternative solutions

Note on user reviews: As BON Credit launched in October 2025, long-term user reviews are limited. Product Hunt shows "No reviews yet" as of December 2025. Early maker feedback is positive, but independent user testimonials are not yet widely available.

Long-term observation: The true test will be whether users stick with the app over 6-12 months and see measurable debt reduction. Check back in mid-2026 for updated user feedback and case studies.